Ethereum is pushing higher, as shown in the daily chart. After last week’s dip and recovery, the second most valuable coin is up nearly 25% from August lows. If buyers take charge today, clearing and closing above $2,600, as is currently the case, it could anchor the base of another uptick toward $3,300 in a buy trend continuation formation.

66% Of All Ethereum Addresses Are In Profit

The possibility of this price action panning out is highly likely. According to IntoTheBlock data, Ethereum is at an intriguing phase and is impressively shaking off weakness seen in the first half of the week.

IntoTheBlock data notes that 66% of Ethereum addresses are in green at spot rates. This development means many holders profit despite the past five months’ volatility and ups and downs after prices peaked in March 2024.

The fact that a large percentage of holders are in profit is bullish and may mean more ETH holders are willing to hold on and see how price action prints out in the coming days.

Typically, whenever a larger percentage of addresses are in the red and losing money, they may seek to exit in a panic, in a self-preservation mode, protecting their bottom line.

Though this is also possible now that prices are rising, entities who may cash out now could miss out on even bigger gains, at least if the past guides. According to IntoTheBlock data, the last time 66% of all ETH addresses were in profits was back in October 2023.

ETH Holders Accumulating, Are Bulls Ready To Take Over?

Around October 2023, looking at historical price action, ETH bounced higher before rallying strongly in the coming months to March 2024, reaching $4,100. While this impressive past performance doesn’t necessarily mean it will be replicated in the days ahead, the recovery of the last few days and other market factors may prop up optimistic buyers.

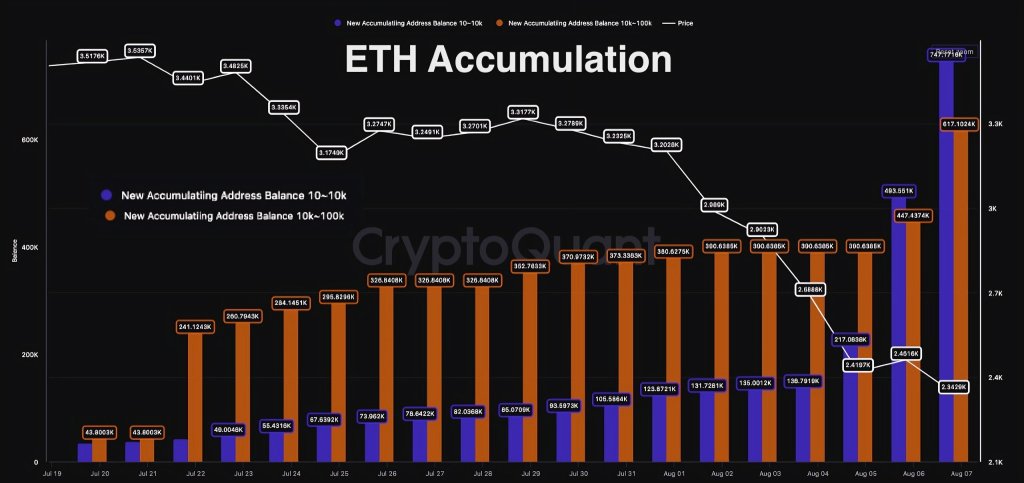

By the end of last week, CryptoQuant data showed that addresses holding between 10 and 10,000 ETH and those holding between 10,000 and 100,000 ETH were busy buying. Their activity saw these cohorts cumulatively add 757,000 ETH, a huge sentiment boost.

That these entities are loading up suggests that they are optimistic about what lies ahead, a net positive for bulls. As of August 12, Ethereum faces headwinds at around $2,700, or August 5 highs.

For the uptrend to continue, there must be a sharp close above this level, ideally with rising volume. This expansion may form the base of a leg-up that may see ETH fly to a July 2024 high of $3,500 in a buy trend continuation formation.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Leave a Reply